All Categories

Featured

Table of Contents

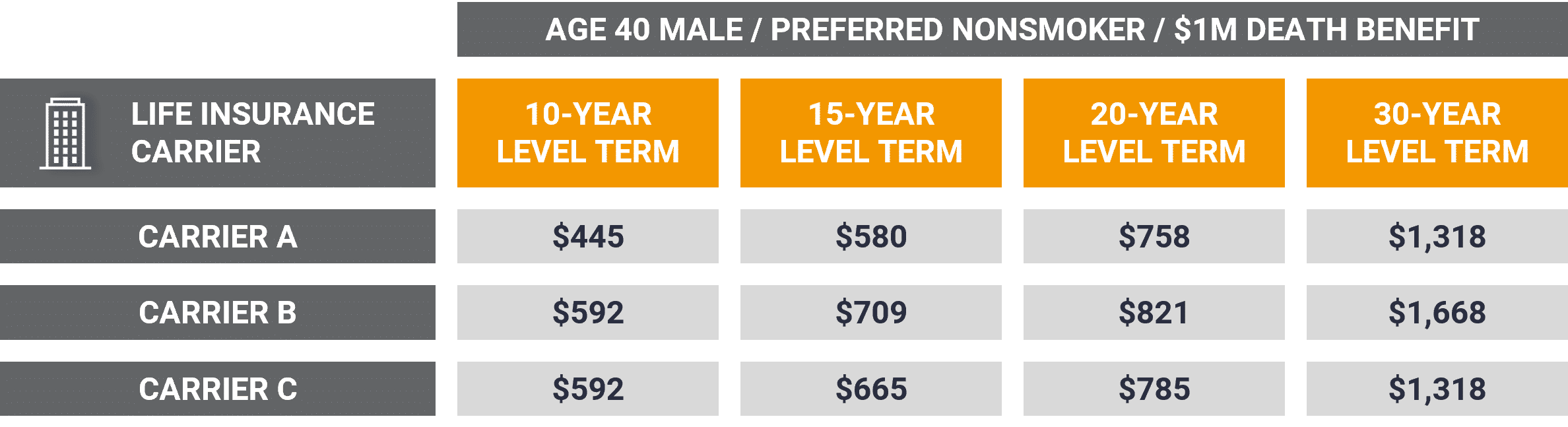

Term policies are also often level-premium, but the overage quantity will certainly stay the very same and not expand. The most usual terms are 10, 15, 20, and 30 years, based on the needs of the insurance policy holder. Level-premium insurance policy is a sort of life insurance coverage in which premiums remain the exact same cost throughout the term, while the amount of coverage supplied rises.

For a term policy, this means for the size of the term (e.g. 20 or 30 years); and for a long-term plan, up until the insured passes away. Over the long run, level-premium settlements are commonly extra economical.

They each look for a 30-year term with $1 million in coverage. Jen acquires an ensured level-premium plan at around $42 each month, with a 30-year horizon, for a total of $500 each year. But Beth numbers she may just need a plan for three-to-five years or up until complete settlement of her current debts.

In year 1, she pays $240 per year, 1 and about $500 by year 5. In years 2 via 5, Jen continues to pay $500 per month, and Beth has paid a standard of just $357 per year for the same $1 million of protection. If Beth no longer requires life insurance policy at year 5, she will certainly have conserved a great deal of money loved one to what Jen paid.

What is Decreasing Term Life Insurance? Learn the Basics?

Yearly as Beth gets older, she faces ever-higher annual premiums. On the other hand, Jen will certainly remain to pay $500 per year. Life insurance companies are able to provide level-premium policies by basically "over-charging" for the earlier years of the plan, accumulating more than what is required actuarially to cover the danger of the insured dying throughout that very early duration.

Long-term life insurance establishes money value that can be borrowed. Plan financings build up passion and unpaid plan fundings and interest will certainly reduce the fatality benefit and cash value of the policy. The quantity of cash money value readily available will normally depend on the kind of long-term plan acquired, the quantity of coverage purchased, the length of time the plan has actually been in force and any superior policy finances.

Disclosures This is a basic description of protection. A complete statement of coverage is found only in the plan. For even more information on insurance coverage, expenses, constraints, and renewability, or to apply for insurance coverage, call your neighborhood State Ranch agent. Insurance plan and/or linked motorcyclists and features might not be available in all states, and policy conditions may vary by state.

Level term life insurance policy is the most simple method to get life cover. Consequently, it's likewise one of the most preferred. If the most awful happens and you pass away, you know precisely what your enjoyed ones will certainly obtain. In this article, we'll discuss what it is, just how it functions and why level term may be right for you.

What is What Is Level Term Life Insurance? Explained Simply

Term life insurance coverage is a kind of policy that lasts a details size of time, called the term. You choose the size of the plan term when you initially take out your life insurance coverage.

Choose your term and your amount of cover. Select the policy that's right for you., you understand your premiums will certainly stay the same throughout the term of the plan.

Life insurance coverage covers most conditions of fatality, however there will be some exemptions in the terms of the policy.

After this, the policy ends and the enduring companion is no longer covered. Joint policies are generally more cost effective than single life insurance coverage plans.

What is Joint Term Life Insurance? The Key Points?

This safeguards the buying power of your cover amount versus inflationLife cover is an excellent thing to have due to the fact that it supplies monetary defense for your dependents if the most awful occurs and you pass away. Your loved ones can also use your life insurance policy payment to pay for your funeral. Whatever they select to do, it's excellent satisfaction for you.

Degree term cover is terrific for fulfilling daily living costs such as family expenses. You can likewise utilize your life insurance policy advantage to cover your interest-only home loan, repayment home mortgage, college fees or any various other financial obligations or continuous settlements. On the various other hand, there are some drawbacks to level cover, compared to various other sorts of life policy.

Term life insurance is a budget-friendly and simple choice for many individuals. You pay premiums monthly and the insurance coverage lasts for the term size, which can be 10, 15, 20, 25 or 30 years. What does level term life insurance mean. However what occurs to your costs as you age depends upon the kind of term life insurance policy protection you purchase.

What is Level Term Life Insurance Policy? Detailed Insights?

As long as you proceed to pay your insurance costs each month, you'll pay the exact same price during the entire term size which, for numerous term policies, is typically 10, 15, 20, 25 or three decades. When the term finishes, you can either choose to finish your life insurance policy protection or renew your life insurance policy plan, normally at a greater rate.

A 35-year-old female in excellent health and wellness can acquire a 30-year, $500,000 Sanctuary Term plan, issued by MassMutual beginning at $29.15 per month. Over the next thirty years, while the plan is in location, the price of the insurance coverage will certainly not transform over the term duration - Level benefit term life insurance. Let's face it, many of us do not like for our bills to expand over time

Your level term price is established by a variety of elements, many of which are associated to your age and health and wellness. Various other elements include your particular term policy, insurance service provider, benefit quantity or payout. Throughout the life insurance policy application procedure, you'll respond to inquiries about your wellness history, consisting of any pre-existing problems like a crucial health problem.

Latest Posts

Cheap Burial Insurance Policies

Whole Life Insurance Quotes Online Instant

Final Expense Insurance Florida